Cost-plus pricing, or “pricing cost plus,” involves adding a fixed percentage to your total costs to set a selling price. This method helps ensure all expenses are covered and a profit is made. This guide explains how to calculate cost-plus pricing, its advantages, and its drawbacks. You’ll also see examples and best practices.

Key Takeaways

- The cost-plus pricing strategy adds a fixed percentage markup to total production costs, helping businesses cover expenses while ensuring a profit margin.

- Regular reviews and adjustments of the markup percentage are crucial for maintaining competitive pricing and aligning with market conditions.

- Cost-plus pricing is advantageous for its simplicity and predictability, but it can overlook market demand and lead to potential pricing misalignments if not carefully monitored.

The Cost Plus Pricing Strategy

The cost-plus pricing strategy, or markup pricing, is fundamentally simple: it involves adding a fixed percentage markup to the total costs of goods or services. This method primarily covers all fixed and variable production costs and ensures a consistent profit margin.

Applying cost-plus pricing requires businesses to account for materials, labor, overhead, and marketing expenses. Total costs are calculated by adding fixed costs (rent, salaries) and variable costs (raw materials, direct labor). A fixed percentage markup is then added to set the selling price.

This pricing method is popular among manufacturers and retailers who need a straightforward way to price their products based on direct production costs. It’s handy for businesses that clearly understand their actual costs, allowing them to effectively utilize the cost-plus pricing strategy. Typical users include small businesses, retailers, department stores, and wholesale retailers.

However, regular reviews and adjustments of the markup percentage are essential to stay competitive and responsive to market changes. An updated understanding of cost structures and market conditions helps businesses keep their pricing appropriate and profitable.

Understanding Cost Plus Pricing

Cost-plus pricing is a strategic approach that adds a fixed percentage markup to the total costs of goods or services. This method includes both direct costs, like materials and labor, and indirect costs, such as rent and utilities. It’s common among manufacturers and retailers, including big names like Costco, who use it to determine selling prices based on direct production costs.

Regularly reviewing and adjusting the markup percentage helps businesses stay competitive and responsive to market changes. The following sections break down the basics of cost-plus pricing and the steps to calculate it effectively.

The Basics of Cost Plus Pricing

At its core, the cost-plus pricing strategy involves adding a fixed percentage markup to total costs. The fundamental principles emphasize covering all expenses while achieving consistent profit margins by focusing on internal factors like production costs.

Businesses determine the selling price by applying a markup percentage to their total production costs, adjusting the percentage based on market factors to ensure competitiveness and profitability.

How to Calculate Cost Plus Pricing

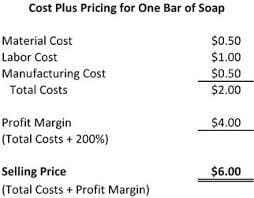

The cost-plus pricing formula is straightforward: Total Costs + (Total Costs x Markup Percentage) = Selling Price. This method involves calculating the total costs, including material, labor, and overhead costs, and then adding a fixed percentage markup.

The markup percentage influences the final selling price, ensuring all production costs are covered while securing the desired profit margin.

Advantages of Cost Plus Pricing

The cost-plus pricing strategy offers several advantages that appeal to many businesses. One of its primary benefits is its simplicity, making it easy to implement and apply. This method provides a straightforward way to cover costs and ensure profitability, enhancing financial predictability and stability.

A cost-plus pricing strategy helps businesses forecast costs and manage profits more effectively, minimizing the risk of unexpected expenses or losses. The following subsections delve deeper into this pricing method's financial predictability and simplicity.

Financial Predictability

Cost-plus pricing ensures that all production costs are covered, eliminating the risk of losses due to unexpected expenses. This pricing strategy allows companies to achieve a consistent rate of return, ensuring reliable profit margins over time.

It also provides predictability based on historical sales data, making it less susceptible to market fluctuations.

Simplicity in Implementation

Cost-plus pricing is easy to implement due to its reliance on internal cost data. Businesses can focus on their cost structure without the complexity of analyzing external market factors. This simplicity can lead to quicker decision-making and less administrative overhead, making it an attractive option for many companies.

Disadvantages of Cost Plus Pricing

While cost-plus pricing has advantages, it also has several drawbacks. One significant disadvantage is its potential to overlook market demand and competitor prices, leading to uncompetitive pricing decisions. Monitoring market demand and competitor pricing is vital for effective cost-plus pricing strategies.

Focusing primarily on production costs rather than market dynamics can limit the adaptability and responsiveness of cost-plus pricing. The following subsections will explore these disadvantages in more detail.

Ignoring Market Demand

Cost-plus pricing can overlook consumer demand and competitor prices, leading to suboptimal pricing decisions. Overlooking market demand can discourage extensive customer research, leading to a misalignment with customer needs. The availability of similar products, advertising pressure, customer income, and external factors can significantly influence pricing decisions.

In highly competitive markets, competition-based pricing may more effectively maintain customer interest.

Risk of Overpricing or Underpricing

Using cost-plus pricing carries the risk of setting selling prices too high or too low due to a lack of market consideration. High prices can scare off customers, especially in elastic markets where even small price increases can lead to significant drops in sales. Conversely, low prices can result in lost profits, even when sales may occur.

Pricing flexibility is crucial for effectively responding to market dynamics and consumer demand shifts.

When to Use Cost Plus Pricing

Cost-plus pricing is beneficial in several scenarios, ensuring all incurred costs are covered plus a profit margin. Cost stability, customer demand, and balance sheets are key reasons for this strategy. Commonly used in construction projects and government contracts, cost-plus pricing ensures expenses are covered plus a profit margin.

The following subsections detail specific environments where cost-plus pricing is particularly effective.

Stable Cost Environments

Cost-plus pricing thrives in environments where costs remain consistent, reducing the need for frequent price adjustments. This stability helps businesses maintain predictable profit margins and avoid frequent price adjustments.

Government Contracts

Government contracts often stipulate a cost-plus pricing model to ensure transparency and predictable cost recovery. Many government contracts require this pricing scheme to guarantee cost recovery plus an additional fee for contractors.

It ensures transparent pricing and allows contractors to recover at a predictable cost.

Implementing Cost Plus Pricing

Implementing cost-plus pricing involves several steps, including calculating total costs, determining the appropriate markup percentage, and adjusting for customer feedback. This method helps businesses shield profitability by allowing adjustments based on production cost increases.

The following subsections break down the process of calculating total costs, setting the markup percentage, and incorporating customer feedback to refine the pricing strategy.

Calculating Total Costs

To effectively implement cost-plus pricing, businesses should calculate total costs, including fixed costs like rent and salaries and variable costs such as raw materials and labor. Understanding overall financial standing and conducting frequent cost reviews are crucial for accurate pricing.

The per-unit cost for manufacturing or retail operations is calculated by dividing the total cost by the number of units sold. Regularly examining costs ensures pricing aligns with company expenditures.

Setting the Markup Percentage

The markup percentage should be established considering factors like industry benchmarks, the competitive landscape, and overarching business goals. Typical markup percentages range from 30% to 50% for retail and 10% to 20% for construction.

To calculate the markup, subtract the unit cost from the sales price, divide by the unit cost, and multiply by 100. This calculation ensures the desired profit margin is achieved while covering all production costs.

Adjusting for Customer Feedback

Incorporating customer feedback allows businesses to fine-tune their pricing strategies, ensuring they remain aligned with customer expectations and perceived value. Regular price adjustments based on feedback help maintain competitiveness and customer satisfaction.

Comparison with Other Pricing Strategies

Comparing cost-plus pricing with other pricing strategies highlights its unique advantages and potential drawbacks. Unlike value-based pricing, which sets prices according to perceived customer value, cost-plus pricing focuses on internal cost factors.

The following subsections explore how cost-plus pricing compares to value-based and competition-based pricing, emphasizing their differences in approach and potential benefits.

Value-Based Pricing vs. Cost Plus Pricing

Value-based pricing centers on what customers believe a product is worth, allowing for potentially higher price points than cost-plus pricing. This strategy is more complex as it requires understanding what customers are willing to pay, necessitating extensive market data and analysis.

In contrast, cost-plus pricing is simpler, focusing on covering production costs and achieving a consistent profit margin. Value-based pricing can yield higher margins by leveraging perceived customer value, but it demands extensive market research and data collection.

Competition-Based Pricing vs. Cost Plus Pricing

Competition-based pricing involves setting prices based on competitors’ strategies to gain or maintain market share. This approach can be more responsive to market conditions and competitor behavior, making it a flexible pricing method.

Relying solely on competition-based pricing can threaten long-term profitability, especially if it leads to price wars and reduced margins. Cost-plus pricing, while less responsive to market dynamics, ensures that all costs are covered and provides stable profit margins.

Best Practices for Effective Cost Plus Strategy

Businesses should adopt several best practices to maximize the benefits of cost-plus pricing. Accurate tracking and calculation of all costs related to a product or service are essential to prevent pricing errors and ensure profitability.

Regular cost monitoring and adaptability to market changes are also crucial for effective cost-plus pricing. The following subsections discuss monitoring costs regularly and adapting to market changes.

Monitoring Costs Regularly

Monitoring costs regularly ensures prices keep pace with significant changes in company expenditures. By tracking fixed and variable costs, businesses can maintain accurate pricing and adjust as needed to reflect actual costs.

Adapting to Market Changes

Adapting cost-plus pricing to market changes is crucial for businesses to remain competitive and responsive to consumer demand. Regular consideration of customer feedback and market conditions can enhance pricing strategies and help companies to avoid the risks of overpricing or underpricing.

Cost Plus Pricing Examples

Real-world examples of cost-plus pricing offer valuable insights into its application across different industries. Many companies use this method to simplify pricing and ensure regulatory compliance.

The following subsections detail examples from the retail and manufacturing industries, illustrating how cost-plus pricing determines selling prices.

Retail Industry Example

In the retail industry, cost-plus pricing is commonly used to determine the selling price of products. For instance, if the total cost to produce a pair of jeans is $55.00 and the markup percentage is 50%, the selling price would be $82.50.

This method covers all production costs while securing a profit margin.

Manufacturing Industry Example

In the manufacturing sector, cost-plus pricing can vary with different production volumes. For example, a manufacturing firm may apply a 50% markup on the total costs of producing widgets, ensuring that all variable costs are covered and a profit margin is achieved.

This approach allows for price adjustments based on production volume and cost fluctuations.

Technology Tools for Cost Plus Pricing

Technology tools are crucial in streamlining the cost-plus pricing process, from calculating costs to setting prices and managing financial data. These tools enhance the accuracy and efficiency of pricing strategies.

The following subsections discuss how ERP systems and pricing optimization software aid in implementing cost-plus pricing effectively.

ERP Systems

Enterprise Resource Planning (ERP) systems integrate various business processes, including finance, production, and sales, providing a comprehensive view of operations. Centralizing and automating data collection, ERP systems streamline the cost calculation process associated with production and operations.

With accurate cost data from ERP systems, businesses can make informed pricing decisions that reflect actual costs and desired profit margins.

Pricing Optimization Software

Pricing optimization software leverages data analytics to refine cost-plus pricing strategies. By integrating real-time cost management, these tools ensure businesses set prices that accurately reflect their costs and desired markups.

Automated cost tracking and analytics help make informed pricing decisions and improve profitability.

Alternative Pricing Strategies

While cost-plus pricing is widely used, alternative pricing strategies offer additional advantages. Methods like value-based pricing, penetration pricing, dynamic pricing, freemium pricing, and MSRP provide different approaches to setting prices based on market conditions and customer demand.

The following subsections further explore dynamic and penetration pricing, highlighting their benefits and applications.

Dynamic Pricing

Dynamic pricing adjusts prices based on real-time demand and competition. This method allows businesses to modify prices according to fluctuating market conditions, increasing prices during peak times and lowering them during off-peak periods.

Pricing optimization software can aid in adapting pricing strategies dynamically based on evolving market conditions.

Penetration Pricing

Penetration pricing sets low initial prices to attract customers and build market share quickly. This strategy involves introducing lower-priced products to gain a large customer base before gradually increasing prices.

It is particularly effective for new market entries aiming to establish a presence and attract customers.

Summary

In summary, the cost-plus pricing strategy offers a straightforward and predictable approach to setting prices by covering all production costs and securing a profit margin.

While it has its advantages, such as simplicity and financial predictability, it also has drawbacks, including the potential to overlook market demand and competitor pricing. By understanding when and how to use cost-plus pricing and leveraging technology tools and best practices, businesses can optimize their pricing strategies to remain competitive and profitable.

Embrace the insights from this guide and apply them to ensure your business thrives in today’s dynamic market.

Frequently Asked Questions About Cost Plus Strategy

What is cost-plus pricing?

Cost-plus pricing involves adding a fixed percentage markup to the total costs of goods or services to set the selling price. This method ensures that all expenses are covered while generating a profit.

How do you calculate the selling price using cost-plus pricing?

To calculate the selling price using cost-plus pricing, add your total costs to the product of the total costs and the desired markup percentage. This formula ensures your selling price covers costs while generating profit.

What are the advantages of cost-plus pricing?

Cost-plus pricing offers financial predictability and simplicity in implementation. It ensures that all production costs are covered while consistently achieving a profit margin, allowing businesses to control pricing and costs effectively.

What are the disadvantages of cost-plus pricing?

Cost-plus pricing can lead to uncompetitive pricing by overlooking market demand and competitor prices, which risks overpricing or underpricing your product. Considering these factors is crucial to ensure your pricing strategy remains effective.

When is cost-plus pricing most effective?

Cost-plus pricing is most effective in stable cost environments and government contracts, where transparency and predictable cost recovery are crucial.

Ready to Implement a Profitable Cost Plus Pricing Strategy?

The cost-plus pricing strategy is just one approach to setting profitable prices, but success hinges on understanding your unique costs, market demands, and customer value perception.

- Learn More: Dive into advanced pricing strategies that could elevate your profitability.

- Discuss Your Strategy: Contact us for tailored advice on setting the right prices to maximize your revenue.

Take the Next Step in Pricing Strategy

🔗 Contact Us

🔗 Schedule a Consultation

About the author

Mark A. Hope is the co-founder and Partner at Asymmetric Marketing, an innovative agency dedicated to creating high-performance sales and marketing systems, campaigns, processes, and strategies tailored for small businesses. With extensive experience spanning various industries, Asymmetric Marketing excels in delivering customized solutions that drive growth and success. If you’re looking to implement the strategies discussed in this article or need expert guidance on enhancing your marketing efforts, Mark is here to help. Contact him at 608-410-4450 or via email at mark.hope@asymmetric.pro.